Divergence Strategy

How to Trade Divergence Accurately

- Always draw a trend line on RSI .

- If we get a Negative divergence , draw a trend line on peaks.

- If we get a Positive divergence , draw a trend line on throughs.

- Always plot the trendline according to the current short-term trend.

- Enter a trade on a confirmed breakout of recent support or resistance.

- Look for entries when the RSI reaches overbought or oversold levels.

Support and Resistance Level

Supply and Demand

These zones represent areas in the market where clusters of buy or sell orders are concentrated, often leading to significant shifts in price movement.

Support and Resistance

These are price levels that the market has tested multiple times but has been unable to break through, indicating strong barriers where buying or selling pressure dominates.

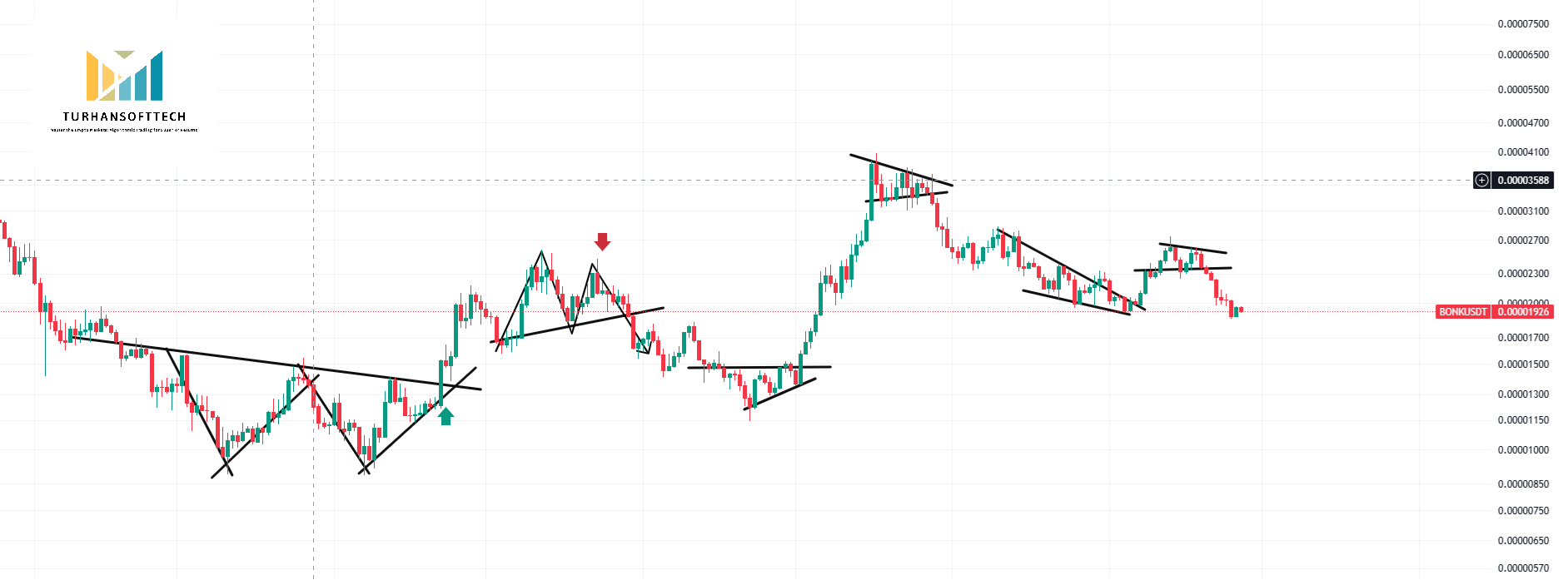

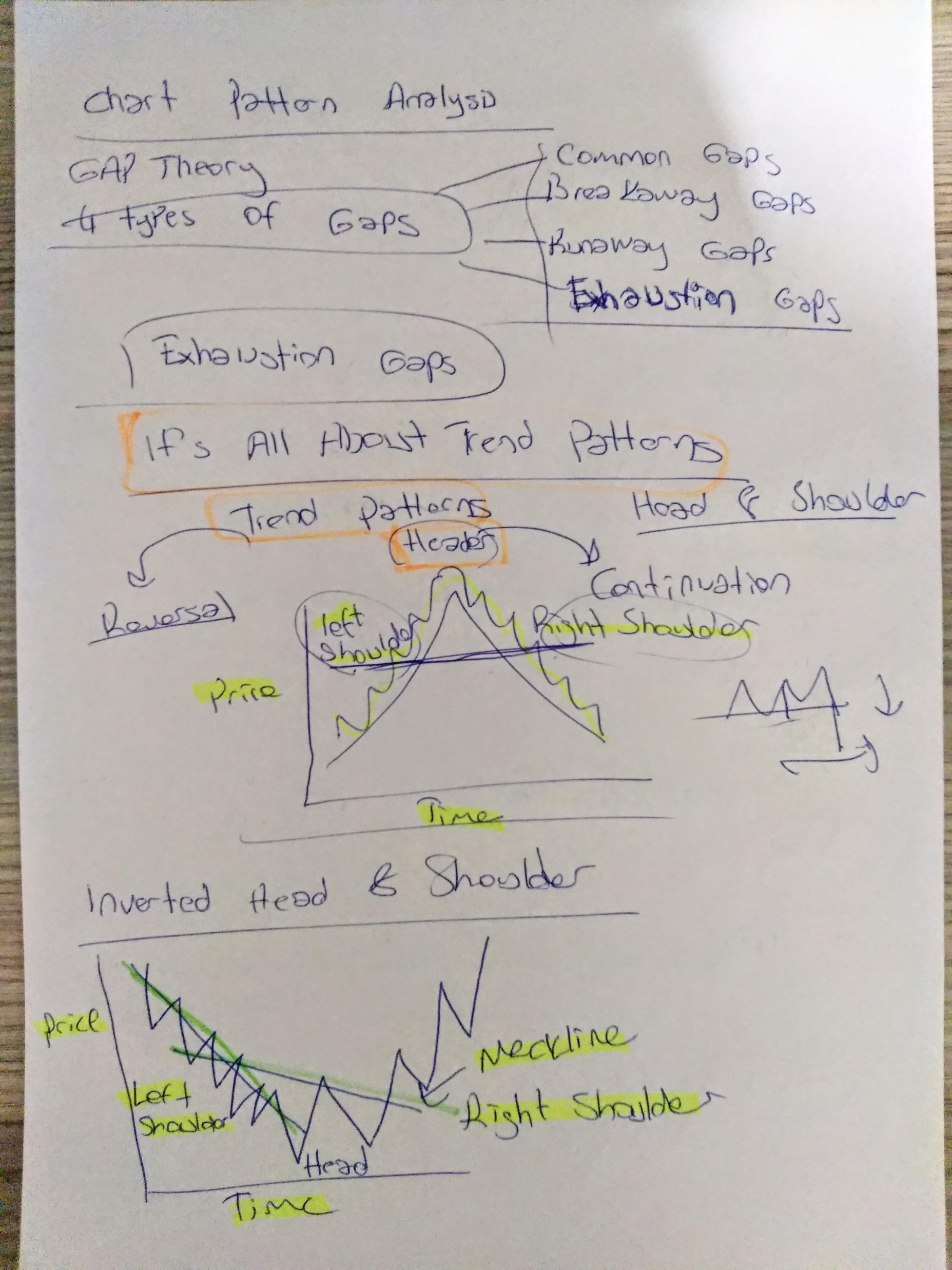

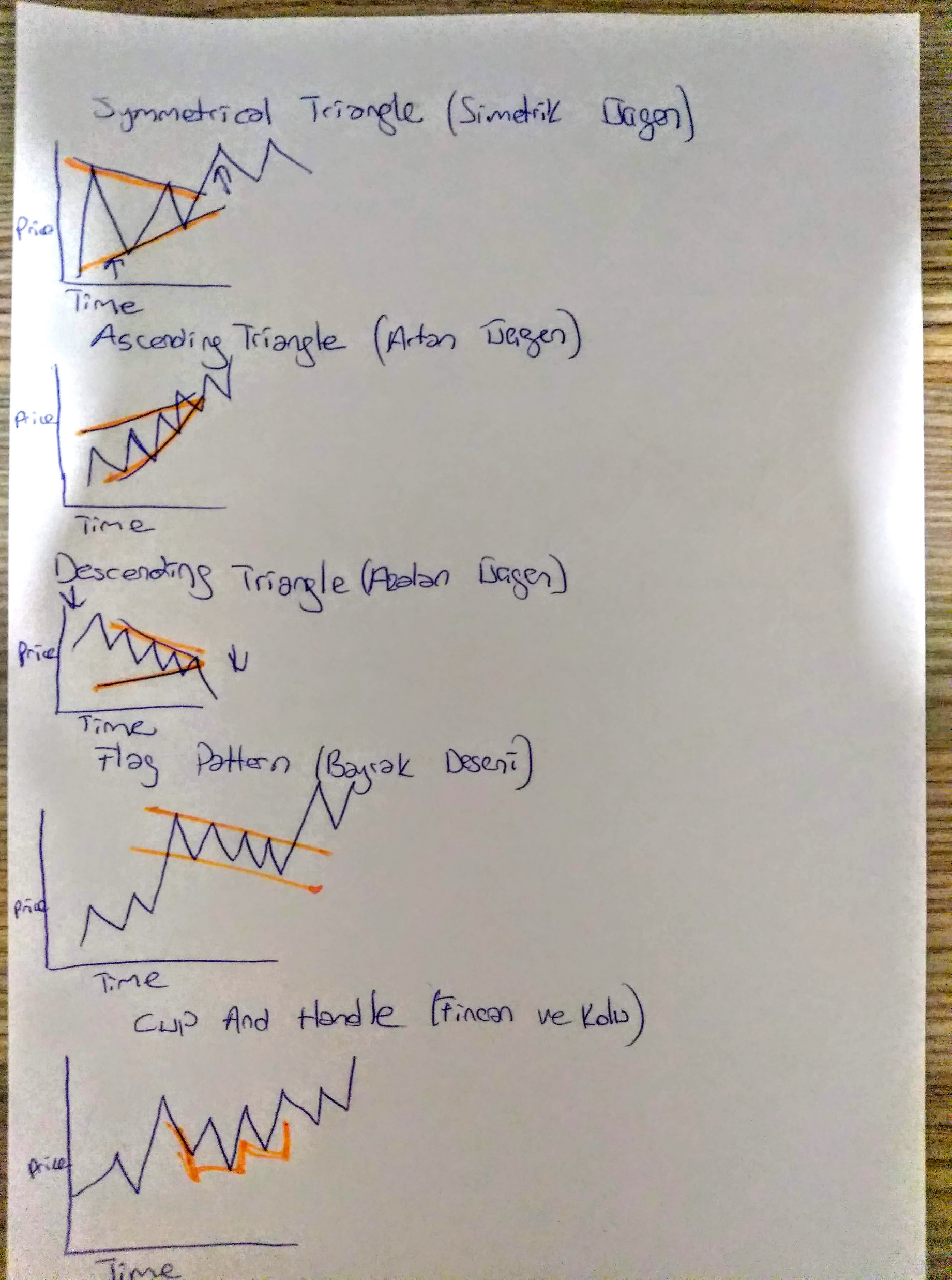

Chart Pattern Strategies

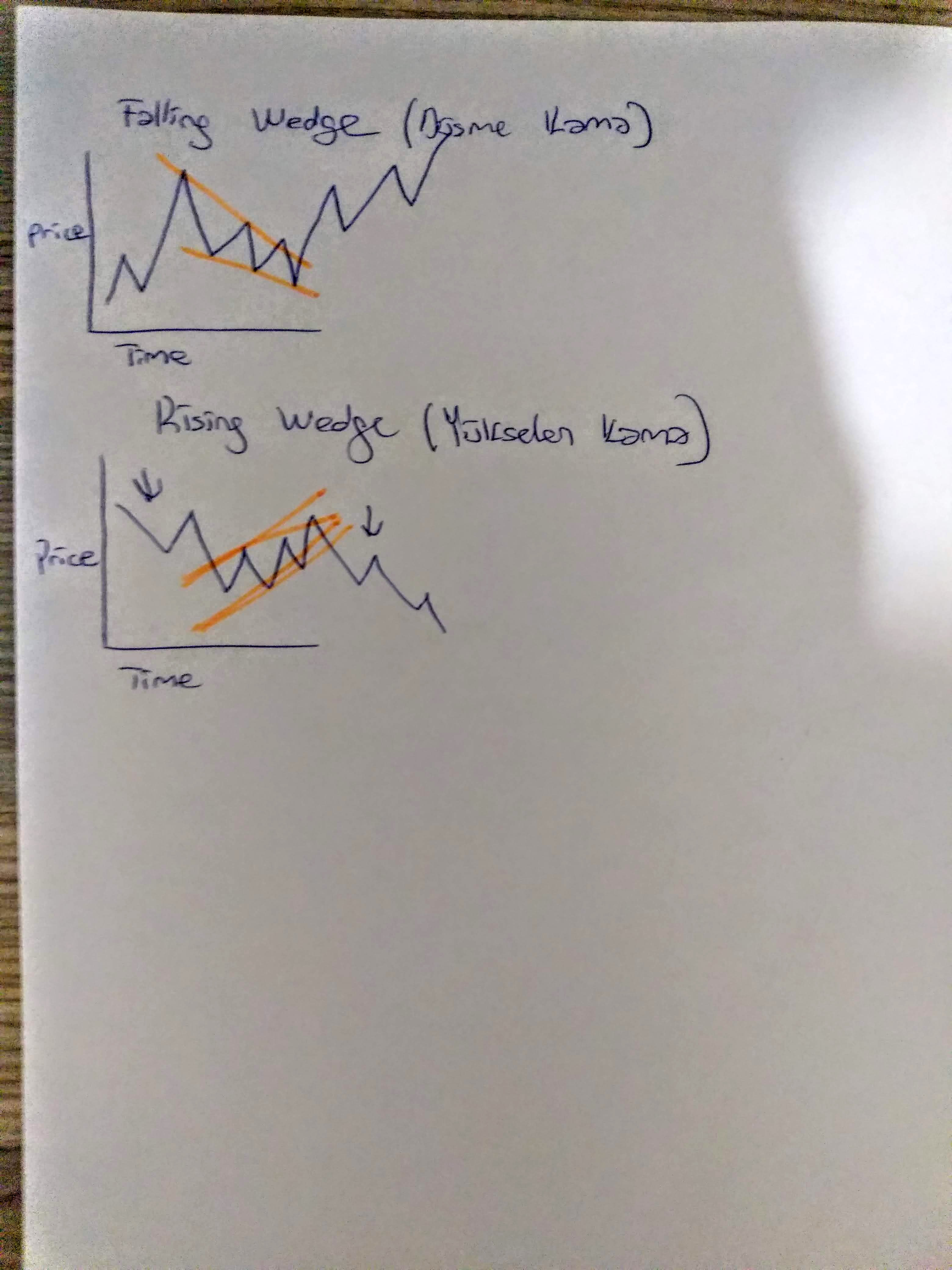

Reversal Pattern Strategies

- Head Shoulder Pattern

- Inverted head & Shoulder Pattern

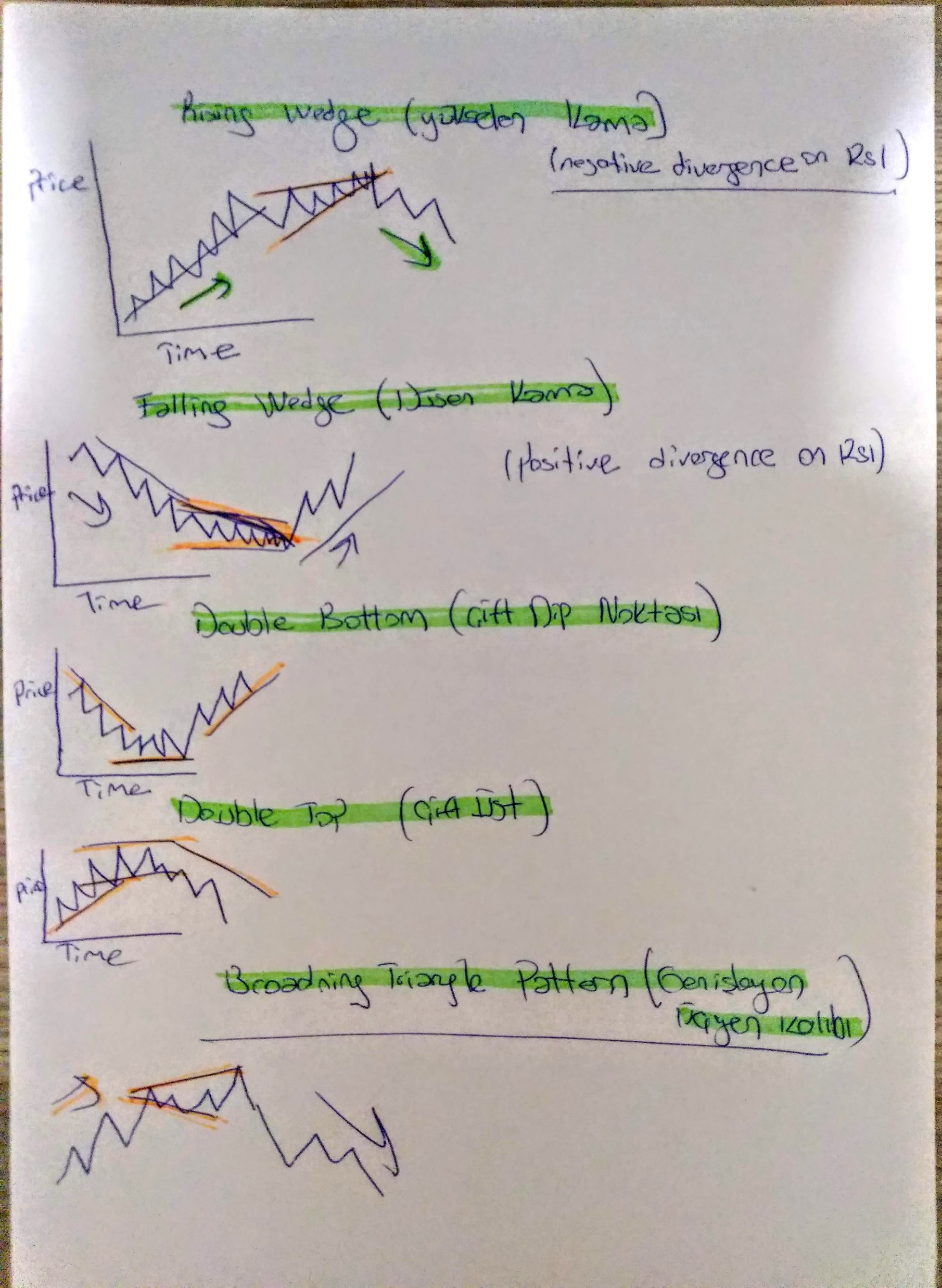

- Double Top Pattern

- Double Bottom Pattern

- Broadening Triangle Pattern

- Failing Wedge

- Rising Wedge

Continuation Pattern Strategies

- Ascending Triangle Pattern

- Descending Triangle Pattern

- Flag Pattern (Uptrend)

- Flag Pattern (Downtrend)

- Pennat Pattern (Uptrend)

- Pennat Pattern (Downtrend)

- Cup & Handle Pattern

- Symmetrical Triangle

Moving Average Strategies

- Buy when shorter period moving average crosses above the longer period moving average.

- Sell when shorter period moving average crosses down the longer period moving average.

- RSI should be added to get accurate results.

- Bullish crossover is called GOLDEN CROSS whereas beraish crossover is calles DEATH CROSS.

Uses Of Bollinger Band

- İndicate Volatility

- Tells about Breakouts

- Continuation of Trend

- Achieve Trend Reversal Signal

Moving Average Strategy

- Apply EMA set of your trading perspective

- Add RSI and BB with EMA set.

- As long as prices is above/below trend line and there is not any divergence signal on RSI, hold the

- position.

- Exit at the breakout of trend line or opposite crossover of EMA set.

Fibbonacci Strategy

Fibonacci Numbers & The Golden Ratio

0, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,144, 233, 377, 610

3 is a sum of numbers 2 and 1

3 = 1 + 2 , 21 = 8 +13 ….

5/3 = 1.6666

8 /5 = 1.6

1.618 is called Golden Ratio Inverse of Golden Ratio = 1/1.618 = 0.618

How To Draw Fibonacci Retracements

- Determine the main trend

- Identify the ABC pattern for a swing

- Use the Fibonacci tool from point A to point B

Fibonacci Important Notes

- Fibonacci retracement levels serve as support in an uptrend and as resistance in a downtrend.

- To plot Fibonacci retracements, apply the tool from low to high or from high to low.

- In Fibonacci convergence, select two swings: the longest swing and the current swing.

- Fibonacci levels are most effective in trending markets. In ranging markets, they are less reliable, but can still be used on lower time frames.

How To Enter A Trade

- Open a position at the 61.8% or 78.6% retracement level.

- Place your Stop Loss just below point A in an uptrend and just above point A in a downtrend.

İmportant Notes

- Determine the primary trend and apply Fibonacci on the ABC points.

- Plot a trendline along the retracement move.

- Use 3D charting and set the corresponding EMA on a lower timeframe.

- Add RSI to detect divergence signals.

- Wait for confirmation before entering the trade.

- Place your Stop Loss at the latest support or resistance level.

- Close the position if any indicator signals an exit.

3D Charting Alignments For Option

- Select your 3D charting setup based on your trading approach.

- Long Term: use Monthly, Weekly, and Daily charts.

- Positional: use Weekly, Daily, and Hourly charts.

- Intraday: use Hourly, 15-Minute, and 5-Minute charts.

- Apply Fibonacci to the larger swing on the higher timeframe.

- On the middle timeframe, draw a trendline and apply Fibonacci to the current swing.

- Use a moving average set on the lower timeframe.

Trend and Trend Lines Strategy

TRENDS

- Up Trend

- Down Trend

- Sideway Trend

To draw a trend line for long term trends , we should use Lagoritmic Scale.

In lagorithmic scale , the difference between two price points is spaced according to the percent change , rather than the absolute change.

Fundamental Analysis

Involves studying company data such as balance sheet, profit & loss statement, and cash flow.

Focuses on understanding why the price has reached its current level.

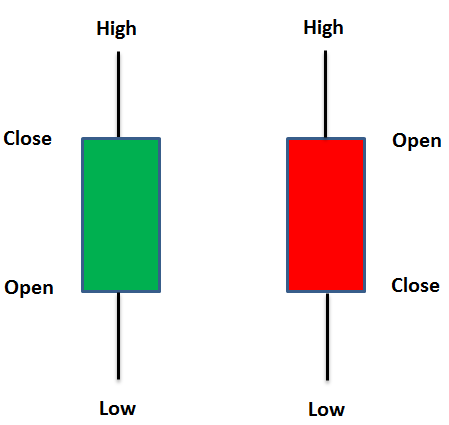

Technical Analysis

Ignores company fundamentals and emphasizes price action. Focuses on what the price is doing

rather than why.

Technical analysis helps forecast price direction because the current price reflects all available

information that can influence it.

Pivot Point Calculations

Pivot Point (P) = High + Low + Close / 3

Resistance 1 (R1) = (P *2 ) – Low

Resistance 2 ( R2) = P + (High – Low)

Support 1 (S1) = (P*2) -High

Support 2 (S2) = P – (High -Low)

Heikin Ashi Chart Calculations

| Price | Candle Stick | Formula |

| Open | Previous Candle | (Open + Close) |

| High | Current Candle | The highest point |

| Low | Current Candle | The lower Point |

| Close | Current Candle | (Open + High + Low + Close) / 4 |

Strong Combination

| Trend Strategies | Divergence Strategies | Chart Pattern Strategies |

| Trend Line Strategies | Moving Average Strategies | Divergence Strategies |

| Fibonacci Strategies | Support & Resistance Stragies | Divergence Strategies |

| Fibonacci Strategies | Dip Trip Strategies | Divergence Strategies |

Simple ATR Stop-Loss Strategy

|

For Short Positions : Stop Loss = Entry Price + (ATR * Multiplier) |